To manage Aotearoa New Zealand’s transition to a low-carbon future, every professional financial decision must take climate change into account. How do we manage this transition? How essential is disclosure in achieving this?

On 28 May 2020, Simpson Grierson, Climate Disclosure Standards Board (CDSB) and the McGuinness Institute hosted a virtual roundtable discussion to hear the perspectives of some of the world’s thought leaders on climate change and finance: Mark Carney (UN Special Envoy for Climate Action and Finance and former Governor of the Bank of England), Adrian Orr (Governor of the Reserve Bank of New Zealand) and James Shaw (Minister for Climate Change, Minister for Statistics and Associate Minister of Finance). They discussed rapid pathways to achieve New Zealand’s transition to a low-carbon future, with a particular focus on the Recommendations of the Task Force on Climate-related Financial Disclosures (TCFD).

The second part of the webinar was a Q&A between the three panellists and other guests: Angela Mentis (CEO, Bank of New Zealand); Matt Whineray (CEO, NZ Super Fund); Mardi McBrien (CEO, CDSB); and Martijn Wilder (founding partner, Pollination Group). The event was co-chaired by Mark Baker-Jones (Simpson Grierson) and Wendy McGuinness (McGuinness Institute).

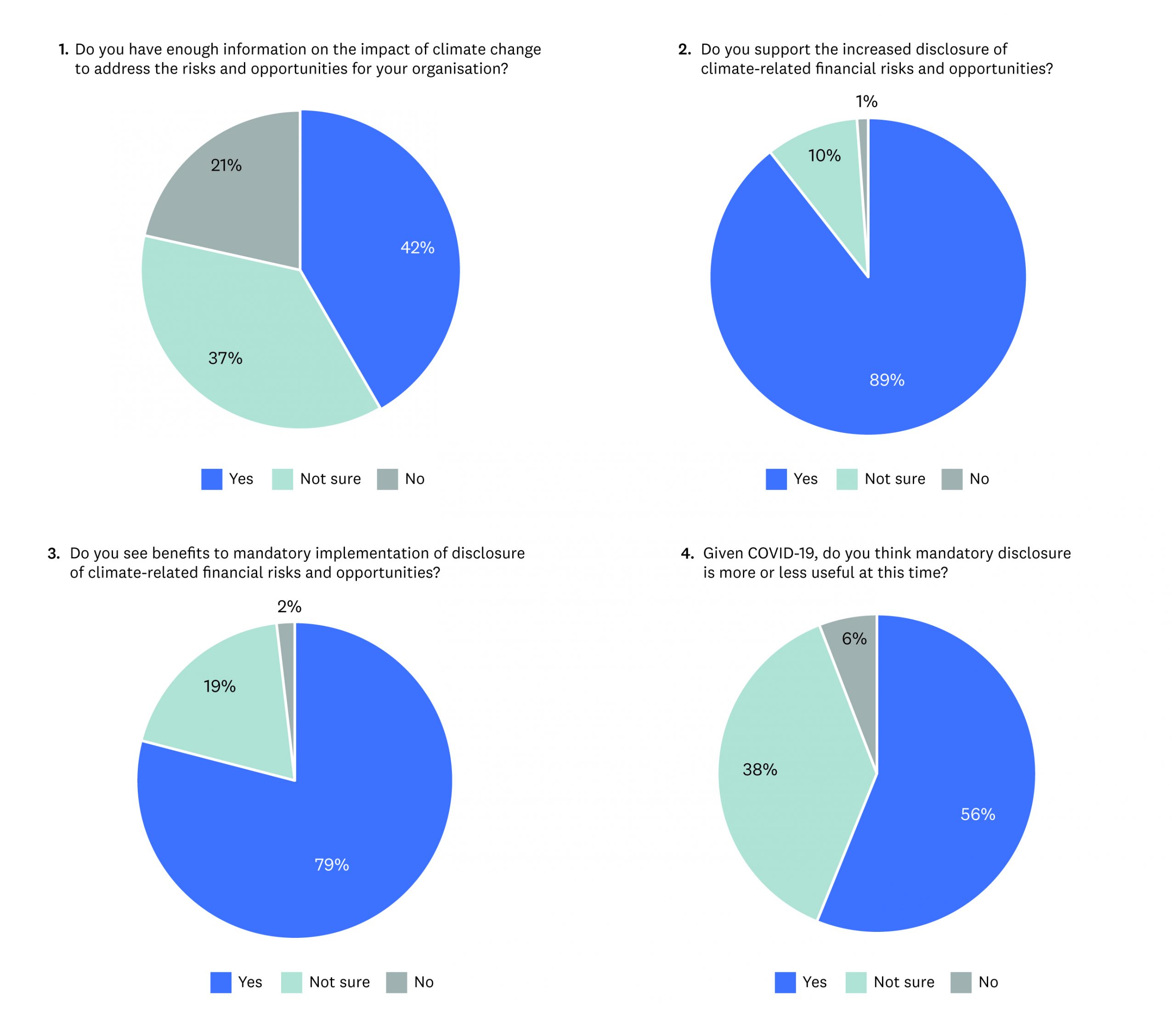

The 2100 plus registrants, as part of the signing up process, were asked to answer four preset questions as means of gauging pre-existing knowledge and attitudes towards TCFD. There was overwhelming support from the majority of respondents on increasing climate-related financial disclosures (89%) and making them mandatory (79%), see pie charts below. This set the course of the event, which discussed how the disclosures are to be embedded, rather than if they should be. The video has been timestamped for ease of use and can be viewed on our YouTube channel here.

Part One: The speakers

First Mark Carney (2:19), who Zoomed in from the UK, discussed the opportunities for companies to create climate transition strategies in the wake of COVID-19. Carney discussed how ‘finance will play a central role in seizing the opportunities as well as managing the risks as we move to net zero’ and that ‘we need a whole of economy transition; net zero will not be achieved in a niche and that is one of the reasons why we need comprehensive disclosure.’ (3:10). Carney goes on to discuss the status of the TCFD, it’s uptake globally, and suggests it is now time for mandatory disclosure. He then goes on to discuss the three R’s that will assist in ensuring that every financial decision takes climate change into account: these being reporting, risk management and returns.

‘We think it is now time for mandatory disclosure.’ – Mark Carney (5:55)

‘The Minister mentioned it and I think it is important, is having the disclosure in the standard financial report, so you’re not hunting around, you’re not having to scrape the website, it’s apples to apples comparisons across companies, across sectors.’ – Mark Carney (40:04)

The second speaker was Adrian Orr (9:54), who discussed how climate change relates to and impacts on financial stability in New Zealand, the Reserve Bank’s climate strategy, and the impact of COVID-19 in terms of risks and opportunities. He noted that the Reserve Bank is ‘very happy to support compulsory disclosure. It needs to be effective. It needs to be meaningful’.

He went on to say:

‘We know that there are significant implications for the New Zealand economy and New Zealand society through climate change. Whether it’s through the physical challenge, sea level rising, adverse weather interrupting key economic activities and society as a whole. As well as the transition challenges that we have, as our Prime Minister outlined, heading towards the zero carbon world. You can get there very abruptly, we don’t want to do that. We want a smooth transition’. – Adrian Orr (13:40)

Adrian Orr concluded his speech with reference to Tāne Māhuta, god of the forest and birds, who separated the earth mother (Patatūānuku) from the sky father (Ranginui) so that the sun could shine through and illuminate the world. He said that ‘disclosure is a tool to let in the sunshine. Better information to make better decisions. The degree to which climate change remains a ‘tragedy of the horizons’ depends on our ability to make better decisions today’.

James Shaw was the final speaker (20:38). He first discussed the natural and financial impacts of climate change that New Zealand is already experiencing, then outlines the New Zealand Government’s recent public consultation on a mandatory (comply or explain) climate-related financial disclosures reporting regime. He highlights that 84% of the respondents agreed that the TCFD framework was appropriate for New Zealand. He also announced in his speech that the government would be looking to work with the External Reporting Board (XRB) as the leading institution to introduce mandatory TCFD disclosures. The XRB is New Zealand’s accounting and assurance standard setting body, which means that if the XRB were to lead this new disclosure regime, climate-related financial disclosures would become a set of standards.

‘We have asked officials … to engage actively with … [XRB] to support that work in developing climate and integrated reporting standards for New Zealand’. – James Shaw (28:45)

Shaw closed with the following remark:

‘There is a real realisation out there that this is a clear and present danger; it is a very material risk. Investors and directors and managers definitely want to know what risks they are exposed to and their businesses are exposed to. Why wouldn’t you want to know what those risks are, so that you can start to work out a plan for mitigating and managing those risks down?’ – James Shaw (29:34)

Part Two: The Q&A

The second part of the event was a Q&A between the three panellists and other guests: Angela Mentis (CEO, Bank of New Zealand); Matt Whineray (CEO, NZ Super Fund); Mardi McBrien (CEO, CDSB); and Martijn Wilder (founding partner, Pollination Group). Each of the Q&A speakers are from organisations at the forefront in terms of engaging with and exploring how to embed climate-reporting into the financial system. They were each invited to ask a question to the three panellists. The questions were varied and insightful, and explored the roles of each of the three panellists in moving towards mandatory reporting. The questions are as follows:

Angela Mentis (to Mark Carney) (31:28): Greater transparency of a banks exposure to climate-related risks and opportunities in its portfolio through TCFD reporting and public commitment, is one mechanism for banks to be part of the solution to achieve a net zero economy. For example, the NAB Group, of which the BNZ is a part of, has begun reporting against the TCFD framework, and has committed to 70 billion in environment financing by 2025 to help address climate change. Another mechanism is to encourage sustainable finance by way of capital relief. There is a great deal of discussion globally about this possibility, notably in the EU where one trillion euro of capital needs to be mobilised to address climate change. Given capital settings ultimately have a basis in risk, both the positive and negative, ESG risks associated with lending could be a highly effective way to signal and ultimately drive changes in capital allocation. What are your thoughts on this and are there any informative examples in offshore markets you could discuss?

Matt Whineray (to Mark Carney) (36:08): Specifically around the application or implementation of the TCFD, when you talk to entities that are going to be required or are required to disclose, what are the impediments that get in the way? I’m interested in that because, when it gets implemented here, we can deal with those issues.

Mardi McBrien (to Adrian Orr) (40:28): The reason that Mark has called this establishment the TCFD is to address the hidden risks of climate change that exist in the financial system at a firm level, but also from a systemic financial stability perspective, which of course is your department as Governor of the Reserve Bank of New Zealand. So if Minister Shaw is successful and the TCFD recommendations become mandatory…and you have firm level information on climate risk available to you across the board, how would this help you in your job of ensuring financial stability in New Zealand?

Martijn Wilder (to James Shaw) (43:35): At the moment we are seeing many governments around the world tying in the need for COVID recovery with the move to a green economy, and interestingly, the Canadian government said that companies over a certain size who would like to receive COVID assistance need to be doing TCFD reporting. In that sense, one of the things that we often hear from companies, which is really not acceptable, is that they’re doing ‘TCFD light’, they think they can just do it in a light way, but you have to do TCFD properly. So from your perspective, being an advocator for moving toward mandatory TCFD, in terms of trying to ensure that companies and the people you’re regulating apply TCFD in a more coherent way. Also, I noticed one of the questions on the chat was ‘to what extent would New Zealand move beyond just listed entities’ – and there is provision for trying to do that. What are your thoughts around both the issue of making sure that TCFD is implemented properly and then, how far and how deep in the economy you implement that?

Part Three: Closing remarks:

Concluding remarks was delivered by Wendy McGuinness. Thank you to all those involved in the event, including our three speakers, the four Q&A panellists, supporters and collaborators. Thank you to Trevor Moeke (principal advisor at New Zealand Treasury and Māori leader) for providing his insights; and Pollination Group for the technical support. Wendy closed the event by thanking her co-hosts, Mark Baker-Jones (Simpson Grierson) and Michael Zimonyi (CDSB) and reciting the whakataukī that was selected by Trevor Moeke especially for the event.

Ko nga pae tata, whakamaua kia tina – For the near horizon and opportunities, seize them!

About the title and the whakataukī:

Choosing the event title A Near Horizon had its own journey. First and foremost, the title was inspired by Mark Carney’s speech A New Horizon in Brussels in 2019. The speech was compelling and succinct in its focus on the roles of banks, investors and policy makers in adapting to and mitigating climate change. His rhetoric has since been repeated and dispersed around the world, inspiring both hope and decisive action.

Mark Carney suggested the byline ‘Seizing the opportunities and managing the risks in the transition to net zero: the importance of climate-related financial disclosures’. For the panellists, speakers, and the various organisations and individuals involved in this event, harnessing and promoting climate-related financial reporting is both the opportunity and the means towards achieving the desired goal, the near horizon: net zero carbon emissions.

The use of the word ‘near’ came out of discussions with Trevor Moeke, the Principal Advisor Crown Māori at The Treasury in Wellington. By coincidence this aligned nicely with Mark Carney’s use of the word ‘seize’ in the byline. The title and the whakataukī were specifically prepared for the event.

Trevor Moeke is of Ngāti Porou, Ngāti Kahungunu and Ngāti Awa Iwi tribal descent lines of the Eastern Seaboard of the North Island of NZ, Trevor works as the Principal Advisor Crown Māori at The Treasury in Wellington. He serves Iwi as the chair of the board of the Kahungunu Assets Holding Company Group. He has worked across private and public sector including roles in broadcasting and technology, Treaty settlements, industry, global indigenous and Māori developments.

Trevor explained that ‘Ko nga pae tata, whakamaua kia tina’ translates to ‘for the near horizon and opportunities, seize them!’. It is part of a larger proverb and call to action, which represents our collective voyage, and a reminder that the responsibility for reaching the near horizon belongs to the person in the present. Trevor provided us with the following insights into the whakataukī: As voyagers; a deep wellspring of knowing in and of the natural world is all important and pervasive. In that deep knowing comes survival, spirit, humanity, futures and prosperity. And, the arts and sciences for intergenerational custodianship. Ours for the environment, and now more than ever, for one another! Hence reach deeply and draw the distant near, and seize the near horizon. Drawn from a deep wellspring within us all and natural world and environment.

Part Four: Ongoing Research

A: Registrants responses to our four questions (pre-webinar)

As part of the event’s registration, participants were asked four questions around the risks and opportunities related to climate change and climate-related financial disclosures. Figures 1–4 below illustrate the responses from approximately 1750 participants regarding the role that they thought climate-related financial disclosures should play for Aotearoa New Zealand’s transition to a low-carbon future.

Figures 1–4: A Near Horizon registration questions

B: Registrants questions (during and post-webinar)

Those who tuned into the webinar were able to put forward additional questions for panellists and others to ponder going forward. As a research and policy institute we are always interested in collecting information on what people think (as this helps drive our work programme). Thank you to those who put forward the following questions. Note, they have been lightly edited.

1. Question to Mark Carney: How confident are you, in your role as a Special Envoy to (the now postponed) COP26 meeting in Glasgow that the rules from COP21 in Paris will be finalised? – KR

2. Question to Mark Carney: In the 2015 Tragedy of the Horizon speech (and other Bank of England research), ‘legal risk’ was separate from ‘transition risk’ and ‘physical risk’. The 2017 TCFD Recommendations included legal risk as part of transition risk. Given that legal risks run counter to physical and transition risks (i.e. opposite direction between parties) do you think there is a case for separately identifying legal risk going forward? – JW

3. Question to Mark Carney: What role do you see for ‘reverse stress tests’? For example, an issue with stress testing prior to the great financial crisis was around the difficulty creating sufficiently extreme scenarios that were simultaneously plausible. Standardised scenarios failed in this regard. An alternative approach is to conduct reverse stress tests, where the test starts with the question: what would it take to make your institution fail? This approach helped define risks and boundaries, including extreme scenarios. – JW

4. Question to Mark Carney: Some financial actors are hesitant to make net zero commitments (particularly banks), often due to the lack of a common framework and reputational risk. TCFD is fantastic and essential but does not necessarily lead to net zero. Are there any net zero principles currently underway? If yes, will they respect the differences between the investment and banking worlds? – CC

5. Question to Adrian Orr : Which climate risks do you consider would have the biggest impact on NZ’s financial system? In particular, given NZ’s unique GHG emissions profile and the fact that it is a bank dominated financial system, are there any specific disclosures needed from our banks? – IDR

6. Question to all panellists: Is there a way in which the public finance system globally can play a role in climate-related disclosures/sustainable finance? – JS

7. Question to all panellists: Disclosure standardisation & mandatory disclosures are both key for greater progress, but the discussion about climate risks in finance has been ongoing for several years, with little change on the ground. What should come next after mandatory disclosures? Can we avoid a more disruptive transition, or is it now inevitable? What other policy tools should be used that are effective to price the externalities (e.g. carbon tax, etc.)? – LZ

8. Question to all panellists: A recent report shows that the public finance institutions of the G20 countries still provide US$77 billion in finance to fossil fuel projects each year (see here). This is three times the finance provided to clean energy, and the fossil fuel finance has not dropped since the Paris Agreement was reached. Since public finance institutions also have a unique signalling and norm-setting role in the world of finance, what can be done to make sure it shifts away from fossil fuels? Would you support the idea of launching a high ambition initiative at the Finance in Common Summit in Paris in November this year in which leading public finance institutions commit to ending fossil fuel finance as part of their Paris Alignment efforts? – LVDB

9. Question to all panellists: Do you have confidence that governments will tax or regulate GHG emissions sufficiently to penalise and thereby reduce emissions to limit climate damage? You seem to be saying everyone should be net zero, which is an implausible outcome as we (individuals, households, firms), are not all equal consumers or producers of emissions. Effective taxes/regulation on emissions would force us to adjust more efficiently. – PB

10 . Question to all panellists: Benchmarking for climate change is key, yes, it’d be good to use it to manage risks. But what about the opportunities that green investments and all the positive externalities that come from that? – JT

11. Question to all panellists: Given the global interconnectedness of everything both in the physical and digital worlds – what are the speakers’ thoughts on how to develop equitable ‘measurement’ through the supply/value chains of natural resources continued for the transition to net zero? – GM

12. Question to all panellists: How can we ensure our imports and exports are appropriately managed to engage in utilising socially responsible green products and services? How can we create a tax to control emissions (e.g. waste/imports)? Likewise, can we implement a benchmark for farming and agriculture to enhance best practice and standards that creates a greener reputation for Aotearoa, and a higher price point and further demand for exports? Ultimately all stakeholders should see financial gain in the medium term. – HG

13. Question to all panellists: What role do you see for local government in the transition to net zero, particularly in terms of reporting climate related financial disclosures. How would this relate to the adaptation of reporting requirements, as set out in s5ZW of the Climate Change Response Act 2002? – HB

14. Question to all panellists: The COVID crisis has shown that we are able to mobilise collective action and make short term sacrifices for longer term benefit in the face of acute risk. Do the panellists have any ideas on how we can achieve the same public buy-in in the face of systemic risk? – RA

15. Question to all panellists: Canada’s Large Employer Emergency Financing Facility will require loan recipients to report on climate-change and sustainability-related risks and opportunities consistent with the TCFD. Do you see this as a good model for other countries as part of COVID-19 relief and recovery packages? – IM

Part Five: Other

Selected press coverage:

Climate risk reporting set to ramp up (Newsroom)

Time for mandatory climate disclosures is now – Carney (Central Banking, paywalled)

Brian Fallow: When climate fight gets real (NZ Herald, paywalled)

Time for mandatory TCFD reporting, says Mark Carney (Expert Investor)

McGuinness Institute publications:

Report 17 – ReportingNZ: Building a Reporting Framework Fit for Purpose (June 2020)

Working Paper 2020/05 – Reviewing Voluntary Reporting Frameworks mentioned in 2019 Annual Reports (June 2020)

Working Paper 2020/04 – Analysis of Climate Reporting in the Public and Private Sectors (June 2020)

Working Paper 2020/03 – Reporting Requirements of Five Types of Entities (June 2020)

Working Paper 2020/01 – Obligations on directors to report risk in New Zealand annual reports under the Companies Act 1993 (May 2020)

Working Paper 2020/02 – The Role of a Directors’ Report: An analysis of the legislative requirements of selected Commonwealth countries (May 2020)

Discussion Paper 2019/01 – The Climate Reporting Emergency: A New Zealand case study (October 2019)